Copper Trading and the Economic Outlook

Copper is one of the most widely used metals in the world since the discovery of electricity by Benjamin Franklin in 1752. The metal, also known as Dr. Copper, has widespread applications in various industries such as electrical products, building industry, transportation, and many more. Many market analysts regard copper prices as a leading indicator of the global economy’s outlook.

Copper prices have risen significantly in the past 2-3 years. The price rise was mainly due to highly bullish demand with the world expecting a recovery from the pandemic. This price rally was observed in almost all metals and energy products around the world. However, recent months have brought this copper rally to a halt with many issues existing from the supply and demand end. Before moving to copper price expectations and its future, let us understand copper as a metal first.

What is Copper?

Copper is a reddish-gold coloured material denoted by the symbol Cu in the periodic table and has the atomic number 29. It is mainly found in hot sulphur solutions created in volcanic regions. The majority of the world’s copper (around 80%) is found in Chile, Indonesia, the USA, Australia, and Canada. Extraction and mining of copper is an extremely difficult process with most of it found in low-grade ores. This is why 1/3 of the copper consumed in most industrial countries is recycled from scrap.

Copper Concentrate

When extracting copper from its ore, copper concentrate is the first commercial product obtained that is a mixture of approximately equal parts of copper, iron, and sulphide. Copper concentrate is smelted and converted to metallic copper. Finally, the metallic copper is processed and cleaned to obtain high-purity copper.

Properties and Applications

Copper has many properties such as malleability, ductility, an extremely good conductor of heat and electricity, and corrosion resistance that makes it highly important. Due to its multiple properties, copper is one of the most widely used metals in the world. From the coins you use to the electrical wires at your home, everything is made of copper. It has applications in various industries such as electrical products, the building industry, transportation, and many more.

Global Market Situation for Copper in 2024

In 2024, the global copper market is beset by a complex array of trends, driven by the interplay of supply and demand fundamentals, geopolitical machinations, and shifting industrial landscapes. On the supply side, forecasts suggest that global copper production will reach 23.6 million metric tonnes, a notable uptick from 2023’s 22.4 million metric tonnes, largely driven by increased output from Chilean, Peruvian, and Australian mines. Inventory levels, meanwhile, remain relatively lean, with LME warehouse stocks hovering around 150,000-200,000 metric tonnes, below the 5-year average, indicating a relatively tight supply situation.

On the demand side, the electrical and electronics sector continues to dominate, accounting for a substantial 60% of total demand, driven by the burgeoning adoption of electric vehicles, renewable energy systems, and advanced electronics. Conversely, the construction sector, which accounts for around 20% of copper demand, is experiencing a marked slowdown in growth, largely due to the ongoing pandemic and economic uncertainty.

The copper price is expected to remain volatile throughout 2024, influenced by the delicate balance of supply and demand, as well as macroeconomic factors such as interest rates and currency fluctuations. Furthermore, geopolitical factors, including the challenges facing the Chilean mining industry and ongoing trade tensions between major economies, may also exert an impact on copper demand and prices. As such, market participants would do well to remain vigilant and adapt to the shifting landscape of this complex and dynamic market.

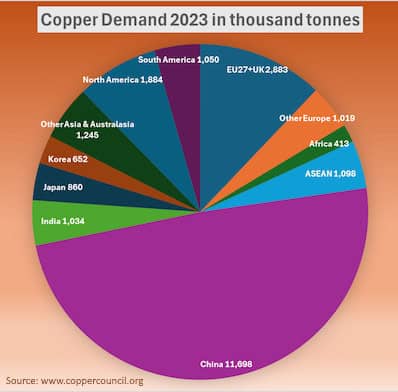

Global Copper Demand

Global copper demand in 2024 is expected to be driven by the increasing need for the metal in the carbon transition and AI revolution. Geographically, there are significant differences in copper demand. China, which accounts for about 50% of global consumption, will continue to be a major driver of copper demand, with its building and construction sector accounting for around 30% of its copper consumption. The Chinese government’s efforts to promote sustainable development and reduce carbon emissions will lead to increased demand for copper-intensive renewable energy technologies, such as wind turbines and solar panels. India is also expected to be a significant driver of copper demand, with its massive infrastructure spending plans, including the development of new metro lines and high-speed rail networks, which will require large amounts of copper for electrification and construction.

The latest forecasts from the IWCC indicate that refined copper demand is expected to experience a modest uptick of 0.8% in 2024, followed by a more substantial increase of 2.3% in 2025, reaching a total of 26,877kt. A breakdown by region shows that China’s demand for refined copper may decline by 0.3% in 2024, but is expected to rebound with a 1.7% increase in 2025, reaching a total of 14,821kt. In Europe, the IWCC anticipates steady growth of 0.4% in 2024, followed by a further 1.7% increase in 2025. Meanwhile, Africa is expected to see a 2.1% increase in demand in 2024, although this growth is projected to be offset by a 12.7% decline in 2025, largely due to Egypt’s market fluctuations. In comparison, the forecast for Asia is a 0.7% increase in refined copper demand in 2024, with a more significant 2.6% growth in 2025, reaching a total of 19,999kt. Finally, the Americas are expected to see a robust growth of 2.1% in both 2024 and 2025.

In contrast, supply-side disruptions in countries like the Democratic Republic of Congo, where production cuts have been implemented due to power shortages and logistical issues, are likely to exacerbate the demand-supply imbalance. The US Inflation Reduction Act, which provides incentives for the development of clean energy technologies, is also expected to boost copper demand in North America. Additionally, the growing adoption of electric vehicles (EVs) globally will drive demand for copper, which is used extensively in EV batteries and charging infrastructure. Overall, the global copper market is expected to remain tight, with demand growing by as much as 20% by 2035 to reach 30 million mt/year, driven by these geographic and sector-specific trends.

Copper Futures

Copper futures contracts are used by various parties such as commodity traders, miners, distributors, corporations, and many others. Traders may use it for speculation, i.e. making profits. On the other hand, traders and distributors also use it for hedging to lock in their profits or limit their losses.

Copper futures were on an uptrend in 2021 with the removal of lockdowns and resumption of economic activities around the world. Additionally, governments around the world were declaring record high stimulus packages with huge infrastructure spending. Due to such high demand, copper prices rose above an all-time high of around $10,500 a tonne in May 2021. Since then, many global events such as the Russia-Ukraine war, increase in interest rates by the US Federal Reserve, and the rising COVID cases in China have led to the fall in copper prices. Traders are liquidating their long positions on copper due to a shortage of funds and supply-demand-related concerns. As a result, copper prices plunged to below $9,000 a tonne in May 2022 for the first time since October.

Currently, Copper futures are on a downtrend with expectations of prices declining further. There is a lot of uncertainty in the short and medium-term. However, copper prices are expected to rise in the long-term scenario.

The Role of Copper in a Green Future

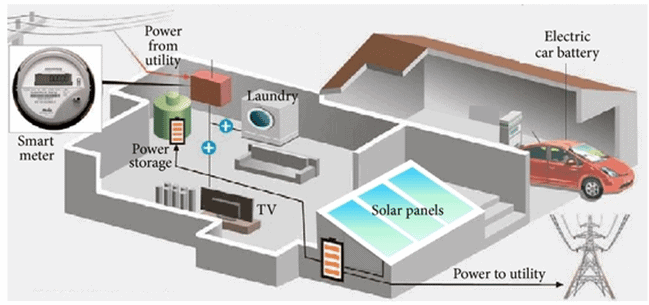

Climate is one of the biggest concerns in the world right now. Increasing temperatures, melting of glaciers, and various other environmental concerns have forced us to rethink how we utilise our resources. As a result, governments around the world are planning for a green revolution by setting targets for becoming carbon-free and shifting towards renewable sources of energy.

Copper will play a crucial role in the green future where we shift to renewable sources such as solar, wind, and water. Being the single best conductor of heat and electricity, the demand for copper will boom in the coming years. There is a huge focus on electric cars. These cars are highly copper intensive in comparison to traditional cars, leading to high demand for copper. A typical petrol-powered car consists of 50 pounds of copper while an electric car generally consists of 184 pounds of copper. Renewable energy sources used to generate electricity typically require 4-5 times more copper than conventional energy sources. As we move toward a decarbonised world, we are replacing C (Carbon) in the periodic table with Cu (Copper).

How to keep the margins up

Trading in Copper futures along with other metals has become highly risky since the Nickel fiasco in March 2022. Russia controls 10% of the Nickel Supply. This supply was choked off with the advent of the Russia-Ukraine War. As a result, the nickel prices shot up from $30,000 to $100,000 per tonne on the London Metal Exchange (LME) within just 2 days. The LME eventually intervened and stopped trading of nickel to bring prices back under control.

Analysts at ING said: “The chaos in the nickel market has spilled uneasiness into other base metals. Elevated volatility in markets currently has made traders extremely cautious, at least until the LME restores market order and reopens nickel for trading. This has seen market liquidity draining out and some margin strapped traders have opted to sell other metals, which put some pressure on prices.”

It is extremely risky to attempt to predict the copper price and take trades without hedging a certain portion of it. Copper futures have become highly volatile with sharp spikes and sudden dips. Only a stabilisation in the global events and resumption of economic activities in China has the potential to bring copper back to its earlier levels. Many banks and other financial institutions have become cautious in their lending for copper trading due to the high risk associated with it. Obtaining finances has become expensive with rising interest rates. Economists around the world are predicting a global recession that was last seen in 2008. To keep margins under control, you should have a good amount of finances and be ready for all scenarios. The past 2-3 years have seen unprecedented prices and this trend is expected to continue for the coming period. As a result, it is very important to protect yourself as risk is at an all-time high.

Bottom Line

Global events have escalated a lot in the past 2-3 years. This has brought an extremely high level of uncertainty to the entire world. Trading in copper and other metals has become extremely risky with margin calls getting triggered every now and then. The Nickel fiasco is a major example of this. All of these exceptional, risky events make it extremely crucial to have proper risk management systems that would protect you from extremities and reduce your financial risk.

About ComFin Software

Since 1997, ComFin Software has been trusted as a global leader for affordable, comprehensive, and agile financial risk management software solutions – categorised as CTRM (Commodity Trading and Risk Management). We have helped companies across the globe to minimise their exposure to volatile markets by arming them with the knowledge, resources, and administrative processes they need to perform commodity trading successfully.

With rising costs and volatility of mining and metallurgy products, it is vital for miners, smelters, traders, and refiners to have a system that covers everything from mining and processing to the final product. Comcore™ offers you tailor-made solutions that enable you to maximise profits while minimising financial risks.

Comcore™ interfaces directly with London Metal Exchange (LME), London Bullion Market Association (LBMA), Intercontinental Exchange (ICE), and the Chicago Mercantile Exchange (NYMEX). With a team of international experts in commodity trading, risk management, and mining & metallurgy, Comcore™ is the one-stop solution for all your mining and metallurgy needs.

The complete Comcore™ software is available in 108 languages.

Furthermore, ComFin Software is recognised for its ability to provide consulting services in all aspects of commodities trading.